The Complete Guide to Pradhan Mantri Mudra Yojana (PMMY) 2026

In a nation teeming with entrepreneurial spirit, access to timely and adequate credit remains the cornerstone for turning ideas into thriving enterprises. Recognizing this, the Government of India launched the Pradhan Mantri Mudra Yojana (PMMY) in 2015, a flagship scheme designed to “fund the unfunded.” As we step into 2026, the scheme continues to be a powerful engine for microeconomic growth, fostering self-employment and supporting the backbone of the Indian economy—the non-corporate, non-farm sector.

This comprehensive guide provides you with everything you need to know about PMMY in 2026, from its core objectives to the step-by-step application process.

What is Pradhan Mantri Mudra Yojana (PMMY)?

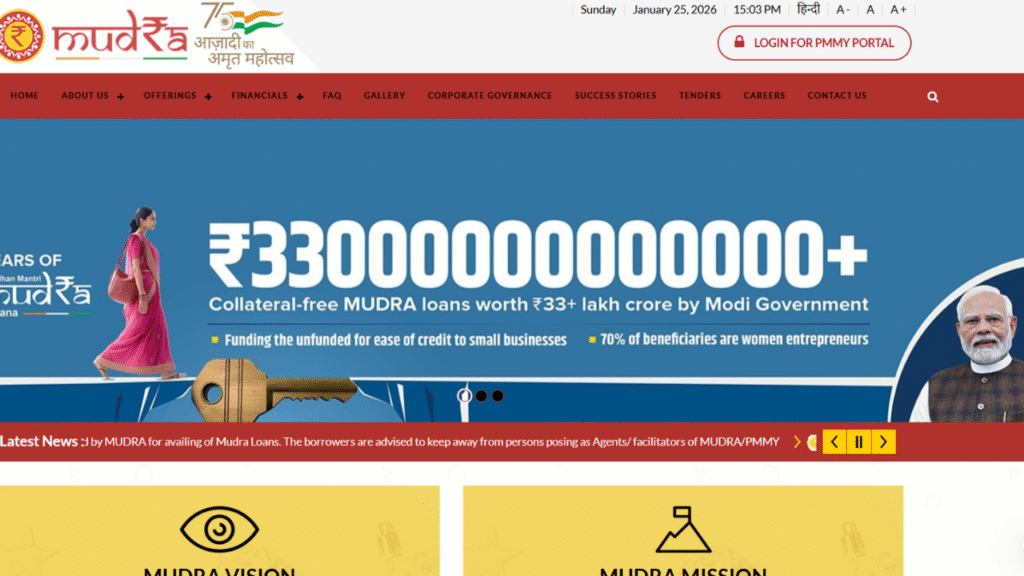

PMMY is a transformative scheme implemented through the Micro Units Development & Refinance Agency (MUDRA), a subsidiary of the Small Industries Development Bank of India (SIDBI). The primary mission is to provide institutional credit up to ₹10 lakh to income-generating micro and small enterprises (MSEs) in the non-farm sector. This includes manufacturing, trading, services, and activities allied to agriculture.

The scheme operates by partnering with financial institutions—Public/Private Sector Banks, Regional Rural Banks (RRBs), Non-Banking Financial Companies (NBFCs), and Micro Finance Institutions (MFIs). MUDRA provides refinance support to these Partner Lending Institutions (PLIs), who then disburse loans directly to eligible borrowers.

Official Websites: udyamimitra.in and mudra.org.in.

The Three Pillars of PMMY: Shishu, Kishor, and Tarun

PMMY categorizes loans into three stages, symbolizing the growth journey of a micro-enterprise:

- Shishu (The Infant Stage):

- Loan Amount: Up to ₹50,000.

- Purpose: For entrepreneurs taking their first steps. Ideal for small beginnings, purchasing basic tools, or seed funding for a new venture.

- Kishor (The Adolescent Stage):

- Loan Amount: Above ₹50,000 and up to ₹5 Lakh.

- Purpose: For established businesses seeking expansion. This could include purchasing additional inventory, upgrading equipment, or increasing working capital.

- Tarun (The Young Adult Stage):

- Loan Amount: Above ₹5 Lakh and up to ₹10 Lakh (Note: The upper limit under PMMY is ₹10 lakh, though some legacy references may mention ₹20 lakh).

- Purpose: For growing enterprises needing substantial funds for scaling up, technology adoption, or significant business enhancement.

Who is Eligible for a Pradhan Mantri Mudra Yojana (PMMY) 2026?

The scheme is remarkably inclusive. Eligible entities include:

- Individuals (including women entrepreneurs)

- Proprietary Concerns

- Partnership Firms

- Private Limited Companies

- Any other entity involved in income-generating activities in the non-farm sector.

Eligible Business Activities (Illustrative List):

- Small manufacturing units

- Shopkeepers, retailers, and traders

- Street vendors (e.g., fruit/vegetable vendors)

- Artisans and craftsmen

- Service sector units (transport, repair services, etc.)

- Activities allied to agriculture: Poultry, Fishery, Beekeeping, Dairy, Agri-processing, Agri-Clinics, etc. (Excludes direct crop loans and land improvement).

Step-by-Step Guide: The Complete Guide to Pradhan Mantri Mudra Yojana (PMMY) 2026

The online application process is streamlined through the Udyamimitra portal.

Step 1: Visit the official portal: https://www.udyamimitra.in/.

Step 2: On the homepage, scroll down to find the “Mudra loans” section and click on the “Apply Now” link.

Step 3: You will be directed to the PMMY Online Registration Form.

Step 4: Enter your Name, Valid Email ID, and Mobile Number. Click “Generate OTP.” Verify the OTP sent to your mobile to complete the initial registration.

Step 5: Log in with your credentials and complete your detailed profile.

Step 6: Fill in the comprehensive PMMY Application Form with all required personal, business, and loan requirement details. Upload necessary documents.

Step 7: Review all information and click “Submit.” Your application will be forwarded to the chosen financial institution for processing.

Pro Tip: The portal provides a useful checklist before you apply. Using it ensures you have all information and documents ready, speeding up the application process.

How to Download PMMY Application Form (PDF) for Offline Application

Not everyone is comfortable with online processes. PMMY loans are available at all bank branches across India. You can also download the application forms directly.

- Go to the MUDRA website’s PMMY Bankers Kit:

https://www.mudra.org.in/Home/PMMYBankersKit. - You will find two main forms:

- Application Form for Shishu: For loans up to ₹50,000.

- Common Loan Application Form for Kishor and Tarun: For loans above ₹50,000 up to ₹10 lakh.

- Click the respective “Download” option to get the PDF.

- Print the form, fill it out manually with accurate details, and submit it along with documents to your preferred bank or NBFC branch.

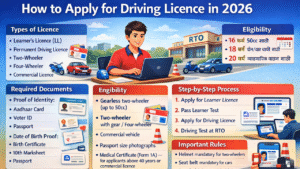

List of Essential Documents Required

While specific requirements may vary slightly between lenders, the standard documents include:

- Identity Proof: Self-attested copy of Aadhaar Card, PAN Card, Voter ID, Passport, or Driving License.

- Address Proof: Recent utility bill (electricity/telephone), property tax receipt, or any of the identity cards mentioned above if it contains the address.

- Business Proof: Relevant licenses, registration certificates (e.g., Udyam Registration, Shop Act license), and ownership proof of the business premises.

- Photographs: Two passport-sized photographs of the proprietor/partners/directors.

- Financial Documents (especially for Kishor/Tarun loans):

- Bank account statement for the last 6 months.

- Income Tax Returns (ITR) and Balance Sheets for the last 2 years (typically for loans ≥ ₹2 lakh).

- A simple Project Report outlining the business plan and viability (for larger loans).

- Caste/Minority Certificate: If applicable (SC/ST/OBC/Minority).

- Statement of Assets and Liabilities (may be required in absence of third-party guarantee).

PMMY Progress & Impact: A Resounding Success

The data speaks volumes about the scheme’s reach and impact since its inception:

| Financial Year | No. of Loans Sanctioned | Amount Sanctioned (in ₹ Crore) | Amount Disbursed (in ₹ Crore) |

|---|---|---|---|

| 2015-16 | 3,48,80,924 | 1,37,449.27 | 1,32,954.73 |

| 2016-17 | 3,97,01,047 | 1,80,528.54 | 1,75,312.13 |

| 2017-18 | 4,81,30,593 | 2,53,677.10 | 2,46,437.40 |

| 2018-19 | 5,98,70,318 | 3,21,722.79 | 3,11,811.38 |

| 2019-20 | 6,22,47,606 | 3,37,495.53 | 3,29,715.03 |

| 2020-21 | 5,07,35,046 | 3,21,759.25 | 3,11,754.47 |

| 2021-22 | 5,37,95,526 | 3,39,110.35 | 3,31,402.20 |

| 2022-23 | 6,23,10,598 | 4,56,537.98 | 4,50,423.66 |

| 2023-24 | Data indicates continued high volume | ||

| 2024-25* | 1,07,78,660* | 1,03,968.72* | 99,177.72* |

| (Partial/Progressive Data)* |

The consistent year-on-year growth, with over 6 crore loans sanctioned annually in recent peak years, underscores how PMMY has become synonymous with entrepreneurial financing in India.

Important Contacts and Helplines

- Primary Contact: The first point of contact should always be your local bank branch or preferred financial institution.

- MUDRA Nodal Officers: SIDBI has appointed Nodal Officers across its regional offices. You can find the complete list of MUDRA Nodal Officers and Bank’s Nodal Officers for PMMY on the official

mudra.org.inwebsite under the ‘Contact Us’ or ‘Downloads’ section. - Toll-Free Numbers & Mission Office: The website also provides access to relevant toll-free numbers (which may vary by bank) and the contact details for the PMMY Mission Office for high-level queries.

Conclusion

As we advance into 2026, the Pradhan Mantri Mudra Yojana remains a pivotal force in democratizing credit access. It is more than just a loan scheme; it’s a catalyst for empowerment, job creation, and economic resilience at the grassroots level. Whether you are a budding entrepreneur with a dream (Shishu), a small business owner looking to grow (Kishor), or an established micro-enterprise aiming for the next level (Tarun), PMMY offers a structured pathway to secure the necessary financial support.

Act Now: Visit udyamimitra.in to begin your online application or download the form from mudra.org.in and approach your nearest bank to fuel your entrepreneurial journey. Remember, checking the official websites for the most recent guidelines and announcements for the year 2026 is always advisable.

This response is AI-generated, for reference only.

Frequently Asked Questions (FAQs) – Pradhan Mantri Mudra Yojana (PMMY) 2026

1. What is Pradhan Mantri Mudra Yojana (PMMY)?

PMMY is a flagship scheme launched by the Government of India to provide institutional credit up to ₹10 lakh to non-farm sector income-generating micro and small enterprises. The scheme is implemented through MUDRA (Micro Units Development & Refinance Agency), a subsidiary of SIDBI.

2. Who is eligible for a PMMY loan?

- Individuals (including women entrepreneurs)

- Proprietary Concerns

- Partnership Firms

- Private Limited Companies

- Any entity involved in manufacturing, trading, services, or activities allied to agriculture (like poultry, fishery, dairy, food processing, etc.).

- The business must be in the non-farm sector with credit needs below ₹10 lakh.

3. What are the three categories of loans under PMMY?

- Shishu: Loans up to ₹50,000 for new and early-stage businesses.

- Kishor: Loans above ₹50,000 and up to ₹5 lakh for established businesses looking to expand.

- Tarun: Loans above ₹5 lakh and up to ₹10 lakh (the scheme ceiling) for growing enterprises.

4. Is PMMY a direct loan from the government?

No. PMMY is not a direct loan. MUDRA provides refinance support to Partner Lending Institutions (PLIs) like Banks, NBFCs, RRBs, and MFIs. These institutions are the ones who sanction and disburse the loan directly to you.

5. What is the maximum loan amount under PMMY in 2026?

The maximum loan amount under the PMMY scheme is ₹10 lakh.

6. What is the interest rate on a Mudra loan?

The Government of India or MUDRA does not fix a uniform interest rate. The rate is determined by the individual Bank or Financial Institution you borrow from, based on their policy, your profile, and the loan category. It is typically market-linked.

7. Is collateral or security required for a Mudra loan?

For Shishu category loans (up to ₹50,000), collateral is generally not required. For Kishor and Tarun categories, the requirement for collateral, security, or a third-party guarantee depends on the lending institution’s internal policies and the loan amount.

8. What are the official websites for PMMY?

udyamimitra.in– For online application and registration.mudra.org.in– For official information, forms, and contact details.

9. How can I apply online for PMMY 2026?

- Visit

https://www.udyamimitra.in/. - Click “Apply Now” under the “Mudra loans” section.

- Register using your mobile number and email.

- Complete your profile and fill out the detailed online application form.

- Submit the form, and it will be forwarded to a financial institution.

10. Can I apply offline? How?

Yes. You can:

- Download the application form PDF from the PMMY Bankers Kit on

mudra.org.in. - Visit the nearest branch of any Public/Private Bank, RRB, NBFC, or MFI that is a PMMY partner.

- Fill out and submit the physical form along with required documents.

11. What documents are required to apply?

Common documents include:

- Identity Proof (Aadhaar, PAN, Voter ID)

- Address Proof

- Business Proof (License, Registration)

- Passport-sized Photographs

- Bank Statements (last 6 months)

- Financial Statements/ITR (for larger loans)

- A simple Project Report (for loans above ₹2 lakh).

12. How long does it take to get a Mudra loan sanctioned?

There is no fixed timeline as it depends on the lending institution, completeness of your application, and verification process. However, the process is designed to be prompt for micro-enterprises.

13. Can I get a Mudra loan to start a new business?

Yes. The Shishu category is specifically designed to fund new startups and early-stage businesses with loans up to ₹50,000.

14. Can existing business loan borrowers switch to PMMY?

Yes, if your existing business loan is for an eligible activity and the amount is within the ₹10 lakh limit, you can discuss the possibility of switching or availing a new loan under PMMY with your bank. This is subject to the bank’s policies.

15. Is there any subsidy on the loan under PMMY?

PMMY itself does not offer an interest rate subsidy. However, the loan is often offered at affordable rates by the lending institutions. Some other government schemes for specific categories (like SC/ST, women) may be clubbed, but PMMY is primarily a credit access scheme.

16. Who should I contact if I have a problem with my application or loan?

- First, contact the Branch Manager of the bank/financial institution where you applied.

- You can also reach out to the designated Bank Nodal Officer for PMMY (list available on

mudra.org.in). - For unresolved issues, you can contact the MUDRA Nodal Officers at SIDBI offices.

17. What happens if I default on a Mudra loan?

Defaulting on any loan has serious consequences: it will negatively impact your credit score, you may face legal action from the bank, and you will be barred from accessing future formal credit. It is crucial to borrow responsibly and ensure you have a repayment plan.

18. Are street vendors and small shopkeepers eligible?

Yes. Shopkeepers, retailers, fruit and vegetable vendors, and other small traders are prime beneficiaries of the PMMY scheme.

19. Can I use the Mudra loan to buy a vehicle for commercial use?

Yes. If the vehicle (e.g., auto-rickshaw, small goods carrier) is for income-generating commercial activity, it is an eligible purpose under PMMY.

20. Where can I see the state-wise performance and data of PMMY?

The official MUDRA website (mudra.org.in) provides detailed data and state-wise progress reports on the number of loans sanctioned and amounts disbursed under the scheme.

YojanaVichar.com एक डिजिटल प्लेटफ़ॉर्म है जो भारत की केंद्र और राज्य सरकार की योजनाओं, कल्याण कार्यक्रमों और जन पहल से जुड़ी नवीनतम जानकारी और मार्गदर्शन प्रदान करता है। इसका उद्देश्य नागरिकों को सही व विश्वसनीय जानकारी देकर सशक्त बनाना है। यहाँ योजनाओं की पात्रता, लाभ, आवेदन प्रक्रिया और आधिकारिक सूचनाएँ सरल भाषा में उपलब्ध कराई जाती हैं। यह प्लेटफ़ॉर्म नियमित अपडेट और तथ्य-जाँच के साथ नागरिकों तक नीतिगत जानकारी पारदर्शिता से पहुँचाता है।