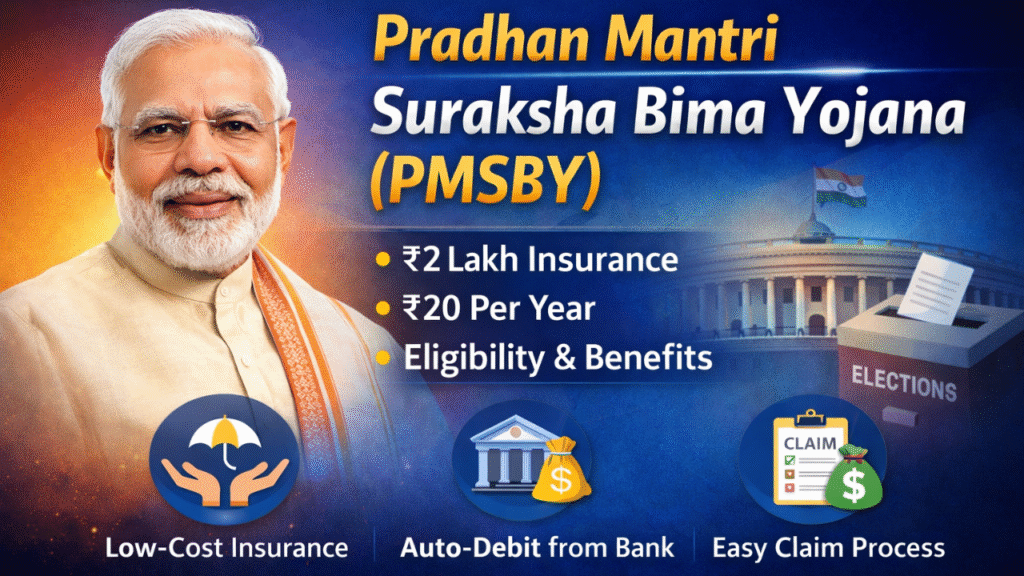

Pradhan Mantri Suraksha Bima Yojana (PMSBY) – Complete Guide

The Pradhan Mantri Suraksha Bima Yojana (PMSBY) is a government-sponsored accident insurance scheme launched to provide affordable financial protection to Indian citizens. Introduced in 2015 by the Government of India, the scheme aims to cover people from economically weaker and middle-income groups against accidental death and disability at a very low premium.

What is Pradhan Mantri Suraksha Bima Yojana?

Pradhan Mantri Suraksha Bima Yojana is an accident insurance scheme linked with a bank account. It provides insurance coverage in case of accidental death or permanent disability of the insured person. The scheme is administered by the Ministry of Finance and implemented through public and private insurance companies in partnership with banks.

Objectives of PMSBY

The main objectives of PMSBY are:

- To provide low-cost accident insurance to all citizens

- To ensure financial support to families after accidental death or disability

- To promote financial inclusion through banking services

- To reduce the economic burden caused by sudden accidents

Insurance Coverage Under PMSBY

The insurance benefits under PMSBY are:

- ₹2,00,000 in case of accidental death

- ₹2,00,000 in case of permanent total disability (loss of both eyes, both hands, both feet, or loss of sight and limb)

- ₹1,00,000 in case of permanent partial disability (loss of one eye, one hand, or one foot)

The coverage applies only to accidents and not to natural death or illness.

Premium Amount

The premium for PMSBY is:

- ₹20 per year per person

The amount is automatically deducted from the insured person’s bank account once every year, generally on or before 1st June.

Eligibility Criteria

To enroll in PMSBY, an applicant must:

- Be an Indian citizen

- Be between 18 and 70 years of age

- Have an active savings bank account

- Have Aadhaar linked with the bank account

- Provide consent for auto-debit of premium

Policy Period

The policy period of PMSBY is:

- From 1st June to 31st May every year

- Renewable annually through auto-debit

How to Apply for PMSBY

Apply Through Bank Branch

- Visit your bank branch

- Request the PMSBY enrollment form

- Fill in personal and nominee details

- Submit Aadhaar and bank details

- Give consent for auto-debit

- Bank enrolls you in the scheme

Apply Through Online Banking

Many banks provide online enrollment:

- Log in to internet or mobile banking

- Select PMSBY option

- Confirm personal details

- Give consent for premium deduction

- Enrollment is completed instantly

Documents Required

- Aadhaar card

- Bank account details

- Mobile number

- Nominee information

No medical examination is required.

Claim Process Under PMSBY

In case of an accident, the nominee or insured person should:

- Inform the bank immediately

- Fill and submit the claim form

- Attach required documents such as:

- FIR or accident report

- Hospital or post-mortem report

- Death certificate (if applicable)

- Disability certificate (if applicable)

- Bank forwards the claim to insurance company

- Approved claim amount is credited to nominee’s bank account

Exclusions Under PMSBY

The scheme does not cover:

- Natural death

- Death due to disease or illness

- Suicide

- Death due to alcohol or drug abuse

- Death due to war or terrorism

Benefits of PMSBY

- Very low premium of ₹20 per year

- Easy enrollment through banks

- No medical tests required

- Government-backed insurance scheme

- Financial protection for family

- Simple claim procedure

Difference Between PMSBY and PMJJBY

| Feature | PMSBY | PMJJBY |

|---|---|---|

| Type of Insurance | Accident Insurance | Life Insurance |

| Coverage | ₹2 lakh (accident) | ₹2 lakh (death) |

| Premium | ₹20/year | ₹436/year |

| Age Limit | 18–70 years | 18–50 years |

Official Website (Ministry of Finance): https://financialservices.gov.in/pradhan-mantri-suraksha-bima-yojana-pmsby

You can use this link in your article as the official reference for:

Scheme details

Benefits

Eligibility

Claim process

Guidelines

FAQs – Pradhan Mantri Suraksha Bima Yojana

Q1. What is PMSBY?

PMSBY is an accident insurance scheme that provides financial support in case of accidental death or disability.

Q2. How much insurance cover is provided?

₹2 lakh for death or total disability and ₹1 lakh for partial disability.

Q3. What is the annual premium of PMSBY?

₹20 per year.

Q4. Who can join PMSBY?

Any Indian citizen aged 18 to 70 years with a bank account.

Q5. Is Aadhaar mandatory for PMSBY?

Yes, Aadhaar must be linked with the bank account.

Q6. Can PMSBY be renewed every year?

Yes, it is renewed annually through auto-debit.

Q7. Is PMSBY valid for natural death?

No, PMSBY covers only accidental death or disability.

Q8. Can I apply for PMSBY online?

Yes, through internet banking or mobile banking.

Q9. What documents are required for claim?

FIR, hospital records, death or disability certificate, and claim form.

Q10. Can I exit PMSBY anytime?

Yes, you can opt out by informing your bank.

Conclusion

Pradhan Mantri Suraksha Bima Yojana is one of the most affordable accident insurance schemes in India. With a premium of just ₹20 per year, it provides essential financial security to families in case of unexpected accidents. The scheme strengthens social security and encourages citizens to join insurance programs through the banking system.

Every eligible citizen should consider enrolling in PMSBY to ensure basic accident insurance coverage for their family.

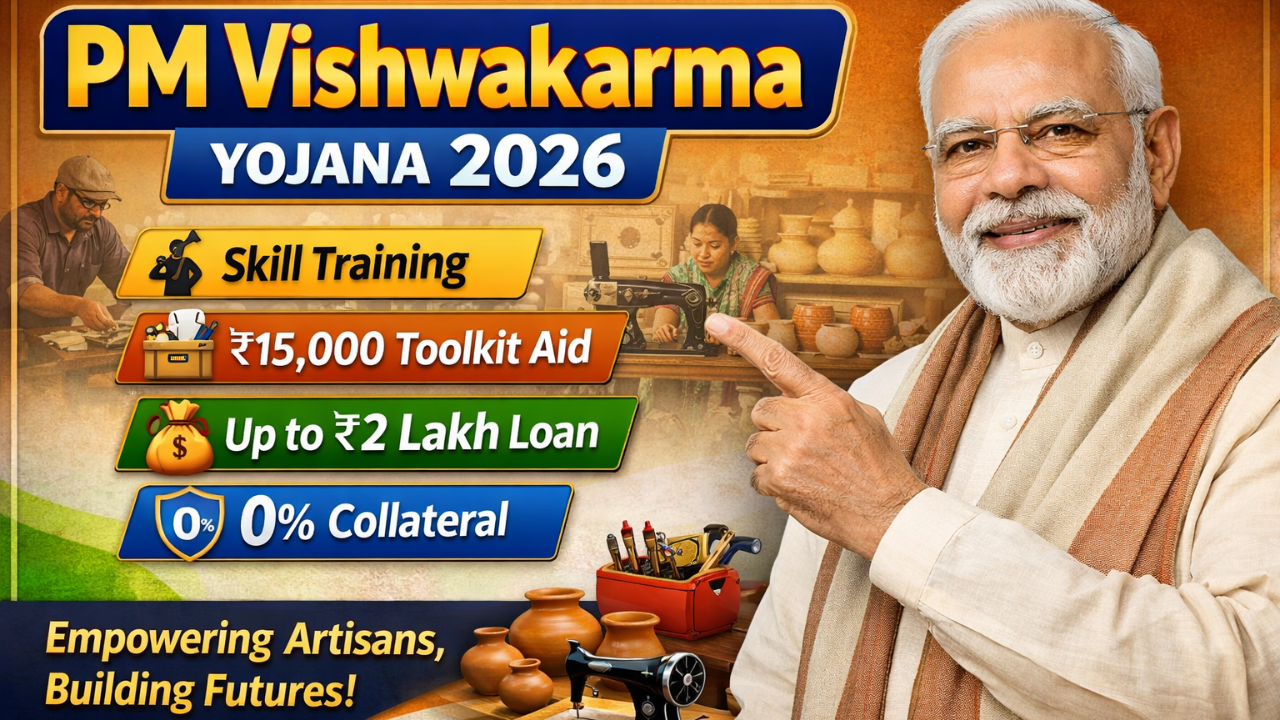

PM Vishwakarma Yojana 2026 – Registration, Benefits, Eligibility & Loan Details

YojanaVichar.com एक डिजिटल प्लेटफ़ॉर्म है जो भारत की केंद्र और राज्य सरकार की योजनाओं, कल्याण कार्यक्रमों और जन पहल से जुड़ी नवीनतम जानकारी और मार्गदर्शन प्रदान करता है। इसका उद्देश्य नागरिकों को सही व विश्वसनीय जानकारी देकर सशक्त बनाना है। यहाँ योजनाओं की पात्रता, लाभ, आवेदन प्रक्रिया और आधिकारिक सूचनाएँ सरल भाषा में उपलब्ध कराई जाती हैं। यह प्लेटफ़ॉर्म नियमित अपडेट और तथ्य-जाँच के साथ नागरिकों तक नीतिगत जानकारी पारदर्शिता से पहुँचाता है।